Cisco Systems is bolstering its growing full-stack observability portfolio with the planned purchase of Israeli startup Epsagon, a company whose platform is designed to enable engineers and developers to trace modern applications in container and serverless environments.

Cisco officials announced the deal today, saying that Epsagon’s technology will be added to the observability platform that the company announced during its virtual Cisco Live conference in March. At the event, company officials said they were bringing together the network visibility capabilities inherited through Cisco’s acquisition of ThousandEyes with the application performance monitoring from AppDynamics and Cisco’s own Intersight management solution.

Neither Cisco nor Epsagon talked about the cost of the deal, though the Globes news site in Israel put the price tag at $500 million.

A Changing IT Environment

In a blog post, Liz Centoni, senior vice president, chief strategy officer and general manager of applications at Cisco, said Epsagon will play a key role in the networking vendor’s observability platform ambitions. Applications have become central to everyday life and how people interact with products and services, Centoni wrote.

Companies are under pressure to accelerate their innovation timelines and embrace cloud-native technologies, microservices and containerized components. At the same time, they also still must rely on traditional IT components, third-party services and application programming interfaces, she wrote.

“This has led to a significant increase in complexity in IT environments,” Centoni wrote. “Multiple teams are involved in figuring out how to monitor the performance, optimization and security of every digital experience, by examining each component, such as application services, networks, infrastructure, cloud and databases, and understanding the insights gathered and their impact to customers’ digital experiences. Traditional domain-centric monitoring tools address only some of these needs and for a single area at a time.”

That echoes what others have been saying. In a blog post in March, Fred McHugh, manager of solution provider WEI’s virtualization, cloud and automation practice, wrote that “visibility alone isn’t exactly enough, you need advanced observability. The concept of observability is gaining rapid momentum as companies accelerate their digital transformation strategies by building out massive cloud-native environments that are hard to observe and operate due to their dynamic and complex nature.”

Also read: Managed Cloud Services for SaaS Companies

Observability Matters

Rob Enderle, principal analyst with The Enderle Group, said observability technologies give operations teams the contextual information to not only identify problems but also to formulate timely fixes. Given the central role of networks in today’s increasingly IT world, it’s not surprising that Cisco is putting a focus on observability.

“Observability products are network-dependent and can be rendered ineffective by slow [or] unreliable [networks] or networks operating below capacity requirements,” Enderle told Enterprise Networking Planet. “The efficacy of the network is therefore directly connected to the effectiveness of the product, creating the need for a critical synergy between the two elements in order to assure adequate performance.”

Cisco’s Full-Stack Observability Platform

Cisco officials said the company’s Full-Stack Observability platform improves the performance, optimization, and security of organization’s IT operations. Cisco launched its Intersight offering in 2017 and added AppDynamics in a $3.7 billion deal that same year. The company bought ThousandEyes last year for $1 billion. The platform drives observability across an enterprise’s applications, network infrastructure and security, delivering real-time insights that are correlated, integrated and given context by artificial intelligence (AI) and machine learning techniques.

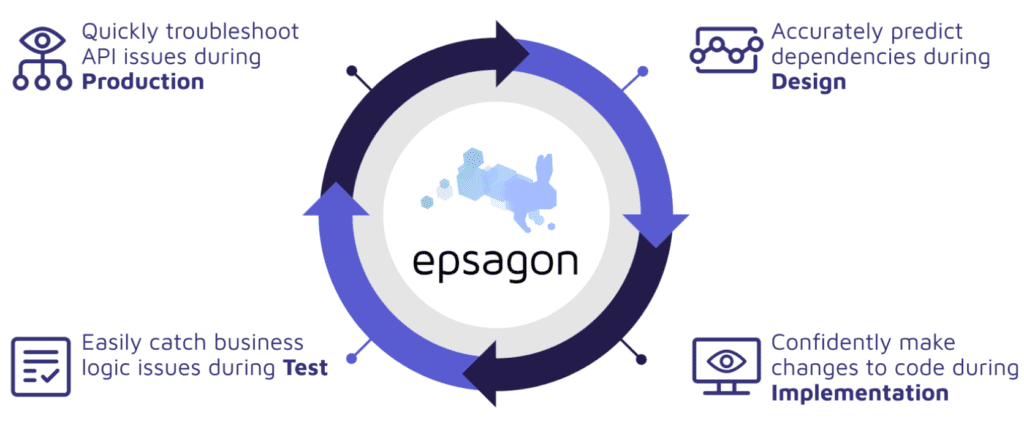

Through this, multiple teams can see the same information and act quickly on it. Epsagon’s software-as-a-service (SaaS) technology will improve the platform’s capabilities around application observability. The company’s platform brings together traces, metrics and logs, correlating the information to help accelerate troubleshooting.

Once the deal closes, Epsagon will be integrated into Cisco’s Strategy, Incubation and Applications group. According to Crunchbase, Epsagon since 2018 has raised $30 million in funding, including $10 million in the latest round in late July.

Evolution of Established Vendors

The focus on such areas as observability and applications is part of Cisco’s larger efforts to transform itself from a seller of networking boxes and related software into an IT solutions and services provider. It’s similar to evolutions that other established tech vendors like Dell Technologies, Hewlett Packard Enterprises and IBM are undergoing with the rise of cloud and edge computing and the creation of modern workloads like AI, machine learning, and analytics.

The focus has shifted to applications in an increasingly distributed and data-centric IT world and away from the underlying hardware. Like its contemporaries, Cisco is adapting its hardware offerings to fit a more modern, cloud-like environment. All these companies are increasingly offering their entire portfolios via an as-a-service model — such as Cisco’s Cisco Plus initiative, HPE’s GreenLake efforts, Dell’s Apex program and Lenovo’s TruScale offerings — and relying more on flexible consumption programs like subscriptions and pay-as-you-go that rely more on recurring revenues than one-time upfront acquisitions.

Such efforts enable Cisco and other vendors the ability to play a key role in the fast-growing hybrid cloud space, where enterprises not only are migrating workloads and data to multiple public clouds run by the likes of Amazon Web Services (AWS), Microsoft, Google, Oracle and IBM, but also are demanding a more cloud-live environment for their on-premises operations, both in traditional data centers and with their own private clouds.

Controlling the Future

For Cisco and other companies, the evolution in many ways is a matter of survival, Enderle said.

“Networking is often a critical part of a solution but rarely a solution in and of itself, much like a power cord is critical to an appliance but will never become one,” the analyst said. “The problem defines the solution and the solution provider therefore has more control over the result than the component maker. Cisco wants more control over their future and thus is evolving from being a critical component maker into more of a solutions provider in order to assure a solutions provider, or group of them, doesn’t render Cisco redundant.”

Staying put as a component maker puts Cisco and other traditional hardware makers at risk of being replaced and the shift to becoming solutions and services vendors is aimed at mitigating the risk. Cisco wants “to assure that what happened to modem makers and message board companies doesn’t happen to them when connectivity technology pivots – and it will pivot – in the future,” he said. “If they control the value chain, they can protect against displacement far better than if they just control a part of that chain.”

Read next: Best DevOps Tools & Software of 2021