Zoom, which was propelled into the higher echelons of an already growing unified communications-as-a-service (UCaaS) market last year by the COVID-19 pandemic and almost immediate shift to remote work and distance learning, is now going to add a cloud-based contact center capability to its growing portfolio.

Company officials this week said Zoom is going to spend $14.7 billion in an all-stock deal to buy Five9, a contact center-as-a-service (CCaaS) provider that has partnered with Zoom in enterprise deals and has been building up its own capabilities through several acquisitions over the past two years. The two companies expect the deal to close in the first half of 2022.

Both vendors have seen rapid growth since the onset of the pandemic early last year, when organizations worldwide sent most employees home to work and temporarily shuttered their offices to mitigate the spread of the virus. That trend has begun to shift with businesses reopening their offices and welcoming back some employees. However, the expectation is that many employees will be able to continue to work from home at least on a part-time basis and with the Five9 acquisition, Zoom is betting that such hybrid working environments are here to stay.

Also read: Maximizing the Benefits of UCaaS

The Hybrid Workforce Trend

It also promises rapid growth for Zoom by adding the $24 billion total addressable market (TAM) in the omni-channel contact center space to its own $62 billion TAM for unified communications.

“The trend towards a hybrid workforce has accelerated over the last year, advancing contact centers’ shift to the cloud and increasing demand by customers for customized and personalized experiences,” Zoom CEO Eric Yuan wrote in a blog post. “Today, enterprises not only need to enable customers to engage via their preferred channel, they need to empower their teams to accomplish more, and do so with empathy, purpose, and connection. We truly believe that together, we will enable customers to reimagine the way they do business and deliver exceptional results.”

The pandemic forced companies to accelerate their adoption of cloud services and to leverage cloud-based collaboration offerings. According to Synergy Research Group, the growth rate of UCaaS subscribers jumped 41 percent year-over-year in 2020. While RingCentral kept hold of its leading 20 percent market share, both Zoom and Microsoft Teams saw rapid growth, with the latter seeing its subscriber base pass the 1 million market and Zoom on the verge of doing the same.

Demand for Zoom, Microsoft Jumps

Both Microsoft and Zoom saw their share of the market jump more than 10 percent, the analysts said in a report. Microsoft Teams is seeing strength in the midmarket while Zoom is surging with large enterprises. As demand skyrocketed at the start of the pandemic – Zoom’s revenue grew by 326 percent in 2020 and its stock price increased 400 percent – the company stumbled when it came to security and privacy, but Yuan responded with a series of moves and the issues did little to stop the company’s momentum throughout the year.

Twenty-year-old Five9 also saw its share of growth during the pandemic, recording several quarters of record revenue increases, including in the first quarter this year, when revenue reached $137.9 million, a 45 percent year-over-year jump. That was fueled in large part by the need of enterprises to enable their call center agents to work from home. The company has more than 2,000 customers, including such brand names as IBM, Comcast, Dow, Coca-Cola, and Blue Cross Blue Shield.

Deal is About Addressing Distributed IT

Yuan and Rowan Trollope, the former Cisco Systems executive who took over as Five9 CEO in 2018, said the deal is about creating a single company that can serve an increasingly distributed IT environment and serve those enterprises that looking to the cloud to enable internal communications as well as improve their outreach to customers through their contact centers.

The two vendors have been collaborating in deals among retail and education customers since last year. During a conference call, both CEOs said joint customers had been telling them that a good situation would be made better if they integrated their solutions.

“As we find more and more of those companies now looking to transition off of their legacy platforms, they really want – especially these large IT buyers – a single communications platform,” Trollope said. “It’s a huge growth and expansion opportunity for Five9.”

Also read: The Growing Value of Enterprise Architects

Expanding Portfolios

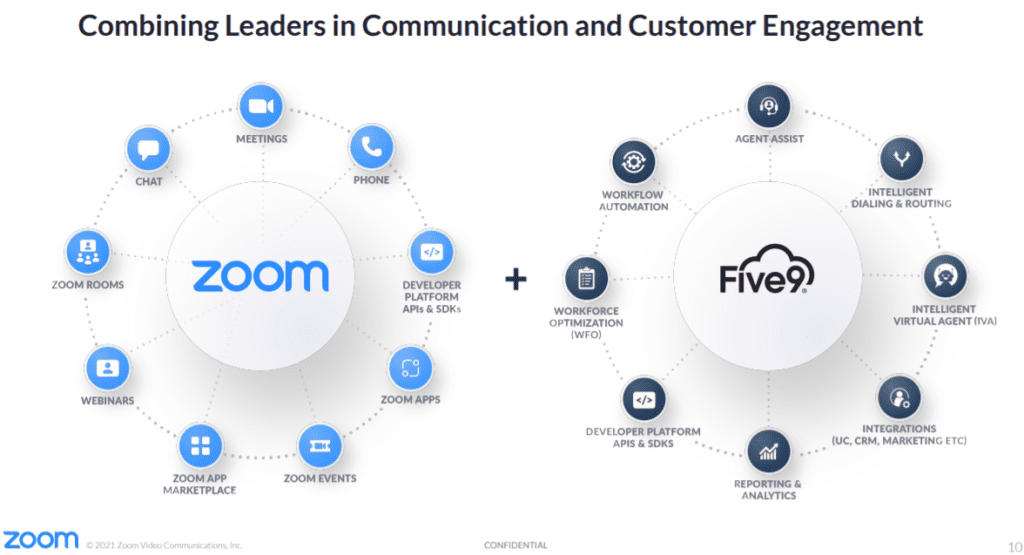

Five9 for more than a year has built out its capabilities around artificial intelligence (AI), workforce optimization and cloud migration for contact centers through both internal development and acquisitions of such vendors as Whendu in 2019 and Inference Solutions and Virtual Observer in 2020.

Zoom also has expanded its portfolio, giving enterprises the ability to use the cloud platform not only for video calls but also for conferences, webinars, and events. In 2019, the company added Zoom Phone, a cloud phone system that enables organizations to use business phones on the video platform. That was an important aspect of the deal, Trollope said, giving the combined organization strength in video collaboration, contact center and business phones.

Bringing video into the contact center arena “is something that has changed very dramatically in the last year,” he said. “Everyone is now comfortable with Zoom. … That’s a very dramatic shift in terms of people’s expectations. It’s really just begun to come into the contact center as we’ve had this big cultural shift globally. That is going to be a huge opportunity in the future … to bring video into the contact center. But even in the short term, there’s a tremendous amount of interest from our customers for simple use cases.”

That includes the ability for retailers or IT tech support to use video cameras to see the problems people are having with their products and to give them instructions based on what they see rather than continue having to do so without a view of the issue.

“Our ability to bring these things together natively is going to be a total game-changer,” Trollope said. “Nobody’s done it and we can absolutely revolutionize the space.”

After the Deal Closes

The Zoom-Five9 deal has been approved by the boards of directors for both companies, but still has to be approved by shareholders and government regulators. Once the deal closes, Five9 will become an operating unit of Zoom, with Trollope continuing as its CEO and becoming president of Zoom, reporting to Yuan. Until then, they will continue to operate as separate companies.

Both executives said that their companies will continue to maintain their partnerships with other vendors as well. For example, Five9 also partners with Cisco, Microsoft Teams and Mitel. Zoom partners include such companies as IBM, Google, Salesforce, Dell Technologies and Citrix Systems.

The Coming Together of UCaaS, CCaaS

The acquisition is the latest in a series of deals and partnerships designed to give unified communications vendors an avenue into contact centers, a market that analysts with Grand View Research predict will grow more than 21 percent a year between now and 2028, when it will reach $90.6 billion.

Cisco earlier this year bolstered its Webex Contact Center portfolio with the acquisition of IMImobile, giving enterprises more modern ways to communicate with customers, including through digital channels like SMS, WhatsApp and Apple Business Chat. Lifesize last year partnered with Omilia to bring conversational AI to its CxEngage cloud contact center platform, a move that came months after Lifesize merged with Serenova to create a single company that offers both UCaaS and CCaaS.

Later in the year UCaaS provider Fuze became a referral partner for Serenova to enable it to also offer enterprises CCaaS capabilities.

Read next: Unified Communications Security Considerations and Solutions