Image: Yingyaipumi/Adobe Stock

SD-WAN gets around the speed and reliability issues traditional wide area networks face. Discover why you should consider adopting SD-WAN technology.

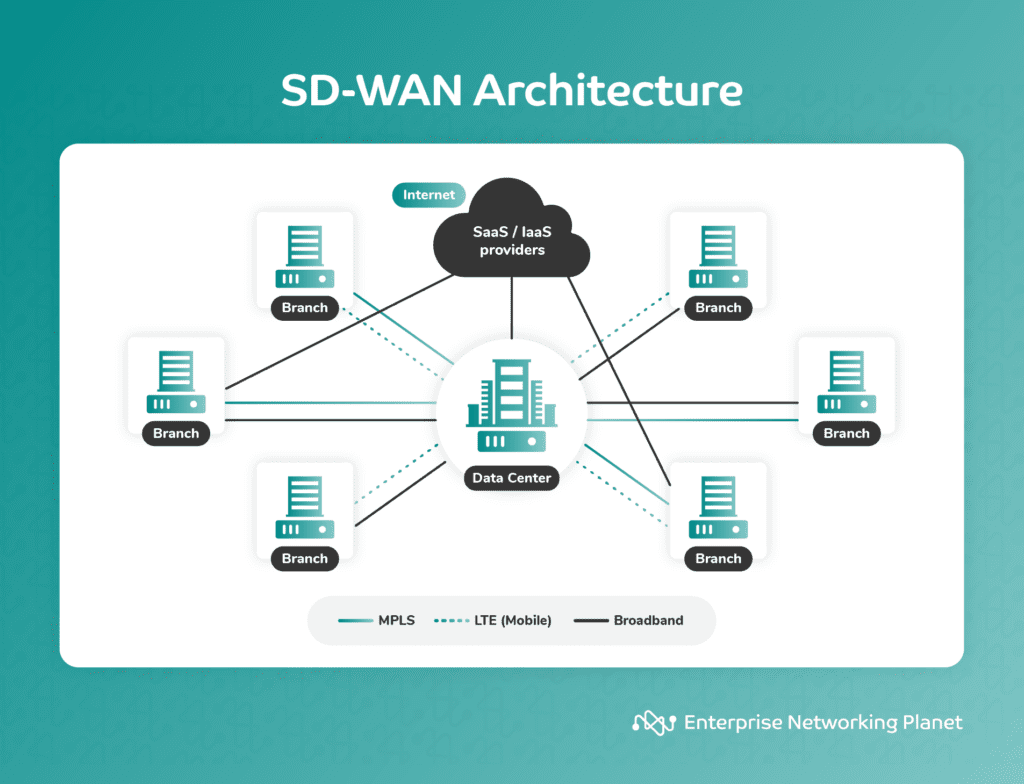

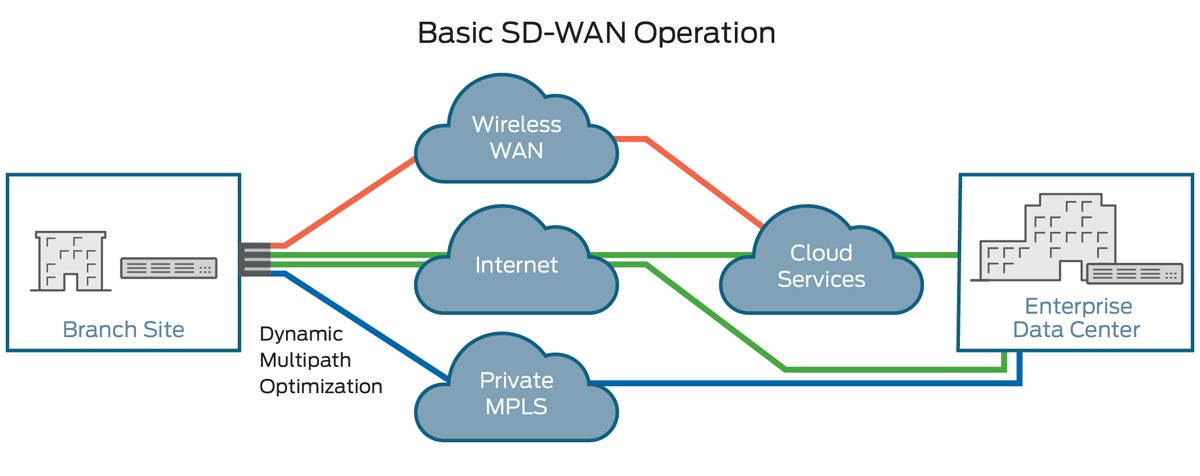

A software-defined wide area network (SD-WAN) is a networking technology that uses a software-based approach to manage and optimize the performance of a WAN. It enables enterprises to combine the capability of various transport services, including multiprotocol label switching (MPLS), long-term evolution (LTE), and broadband internet services, to connect users to applications securely.

As businesses grow, linking branch offices with headquarters in one larger network becomes necessary. However, traditional WAN technology has several limitations, especially regarding reliability and speed. SD-WAN addresses these issues, making it an increasingly popular WAN option.

Knowing the challenges SD-WAN solves will help you understand how it can function in your organization. These solutions include improving network connection quality, reducing network downtime, and lowering infrastructure expenditures.

A standard WAN connection often sees high latency and packet loss, particularly as you move away from large metro areas with more plentiful bandwidth. Adding backup or secondary WAN links doesn’t help much when latency becomes an issue.

So how do you fix it?

SD-WAN can solve these problems by applying various techniques to relieve congestion on your network without requiring an overhaul of your existing infrastructure. For example, if latency issues affect your users on a particular link, SD-WAN could temporarily shift traffic to another link with less traffic. If one of your links goes down completely, SD-WAN could automatically reroute traffic through another link until repairs are made.

Network downtime is a period when your network system is inaccessible. There is both planned and unplanned network downtime. In this case, we are focused on the unplanned network downtime.

ITIC’s hourly cost of downtime survey revealed that 98% of respondents say a single hour of downtime costs over $100,000, and 81% of organizations indicated that the same period costs their business over $300,000.

SD-WAN prevents interruptions and outages by making application failover seamless and straightforward. SD-WAN offers automated failover capabilities, so traffic will immediately be routed through a secondary link (without human intervention) if your primary connection fails. This automation frees IT staff to focus on other projects rather than being tied up monitoring their networks 24/7.

Managing multiple hardware-based routers, firewalls, and other networking devices across various locations incurs high costs and requires specialized IT expertise. With SD-WAN, organizations can significantly reduce bandwidth costs, and since SD-WAN is software-based, there’s no need for expensive hardware.

Traditional WAN services use Layer 2 and 3 virtual private networks (VPNs) to direct traffic to an internet gateway. SD-WAN uses centralized control to securely direct WAN traffic to SaaS and IaaS providers.

Unlike traditional routers that simply route packets from one location to another, SD-WAN uses a cloud service with intelligence built into it. The service monitors network conditions across all your branch sites to route traffic through optimal connections. The service will then dynamically route data between available networks.

This means that network failures or congestion can be handled quickly with minimal impact on your organization’s productivity.

SD-WAN intelligently routes network traffic based on policies and conditions defined by administrators. It can determine the best path for specific types of traffic, such as critical business applications or real-time communication, to ensure optimal performance and reliability.

SD-WAN leverages any combination of transport services — including MPLS, LTE, and broadband internet services — to dynamically select the most appropriate link for each application or traffic flow. This ensures efficient use of available bandwidth and improves the overall network performance.

Traditional WANs are expensive, inflexible, and difficult to manage. They require specialized skill sets for configuration, monitoring, troubleshooting, etc. These challenges are compounded when you have remote sites that need access to your corporate network.

And because traditional WAN solutions lack visibility into application performance, they’re not well suited for applications with strict quality of service (QoS) requirements.

By contrast, SD-WAN provides a more straightforward, cost-effective way to connect branch offices with headquarters. SD-WAN can improve security by offering built-in DDoS protection and end-to-end encryption for secure communications between sites.

Plus, it allows organizations to dynamically steer traffic based on application needs — ensuring that critical business data isn’t impacted by noncritical activity.

SD-WAN is a software layer that sits between an enterprise’s existing branch routers and its cloud provider, usually functioning as connective tissue between two disparate networks. The technology allows companies to connect multiple branches with various types of links or internet service providers (ISPs), creating a unified network no matter how many locations are involved.

To do so, it must automatically determine where data should be sent for optimal performance. This means that even if a user accesses their company’s VPN from home over their ISP connection, all of their traffic will be routed through whichever link provides optimal speed at any given time.

This makes it possible to create one cohesive virtualized network across all sites rather than managing each location separately.

SD-WAN provides increased flexibility by letting you optimize various features and traffic flows, with or without IT intervention. At their core, SD-WAN solutions are built to work on your existing infrastructure while allowing you to scale as needed.

Also known as MPLS, multi-protocol label switching provides greater control over a business’s WAN because it lets you change from one protocol to another based on what works best at any given time. For example, MPLS gives companies more freedom when setting up their WANs because they can easily adjust how they move data from one location to another, depending on current needs.

Because SD-WAN lets you take advantage of real-time monitoring and analytics, there’s no need to hire additional staff members to keep an eye on things. That means that even if you don’t have dedicated IT support, there will still be people around who know how to use your network efficiently — because SD-WAN does all that heavy lifting for them.

SD-WAN provides real-time traffic-shaping capabilities, allowing businesses to prioritize different kinds of data. In addition to prioritizing certain types of data, companies can block unwanted content, such as malware and phishing attacks, before reaching end users.

With complete visibility into applications within your organization, you’ll be able to see precisely where bottlenecks exist so that you can solve them quickly and easily without sacrificing performance. This insight benefits companies that rely heavily on bandwidth-heavy applications like videoconferencing, VoIP calls, and other cloud services.

Businesses can save money and increase efficiency by connecting to several cloud platforms. If a company relies heavily on public clouds for backup purposes, having access to several providers makes it easier to ensure backups run smoothly.

SD-WAN helps businesses connect their locations remotely with more bandwidth, lower latency, and greater security than traditional networks that rely on hardware for processing power. Below are some additional benefits of SD-WAN.

Moving to SD-WAN can significantly reduce your annual operating expenditure (OpEx) because you don’t need to invest in expensive hardware anymore — not to mention data center space, equipment maintenance, etc. Your software only requires a license fee and support, which is much cheaper than buying new networking equipment every few years.

When using internet mode, if one link fails, all traffic goes down until another path is found. On the other hand, MPLS provides multi-path routing that enables automatic failover in case one link fails. So even if one link goes down due to failure, other links will still work, thus ensuring continuous connectivity.

SD-WAN can detect and respond to network problems faster and more efficiently than a human operator. It does so by continuously monitoring network health, performance, and availability.

SD-WAN detects any disruption in the network, and it responds accordingly. For example, if one link goes down due to failure, SD-WAN immediately reroutes traffic through other available paths without manual intervention. This ensures your data always reaches its destination without any loss or delay.

An SD-WAN service helps enterprises maximize productivity by creating resilient WAN networks that enhance application performance in uncertain or unreliable circumstances. This is achieved through intelligent path selection based on dynamic criteria such as cost, latency, bandwidth, jitter, and packet loss. This results in a highly reliable network with minimal downtime for critical applications.

With that in mind, common SD-WAN use cases could include:

The short answer is, “yes, but.”

While SD-WAN offers many productivity-related benefits, including optimized performance, network reliability, flexibility, and cost reduction, if not implemented properly it may actually expose you to greater security risks.

When using SD-WAN, traffic flows directly from branch locations to the public internet, which means the traffic bypasses traditional security measures. This could leave the network vulnerable to external threats.

Nonetheless, SD-WAN can be secure, but the level of security depends on various factors, including the specific implementation, configuration, and security measures put in place. Many organizations even consider SD-WAN to enhance their network security as it provides several security features and benefits such as encryption, firewalls, segmentation, and centralized security management.

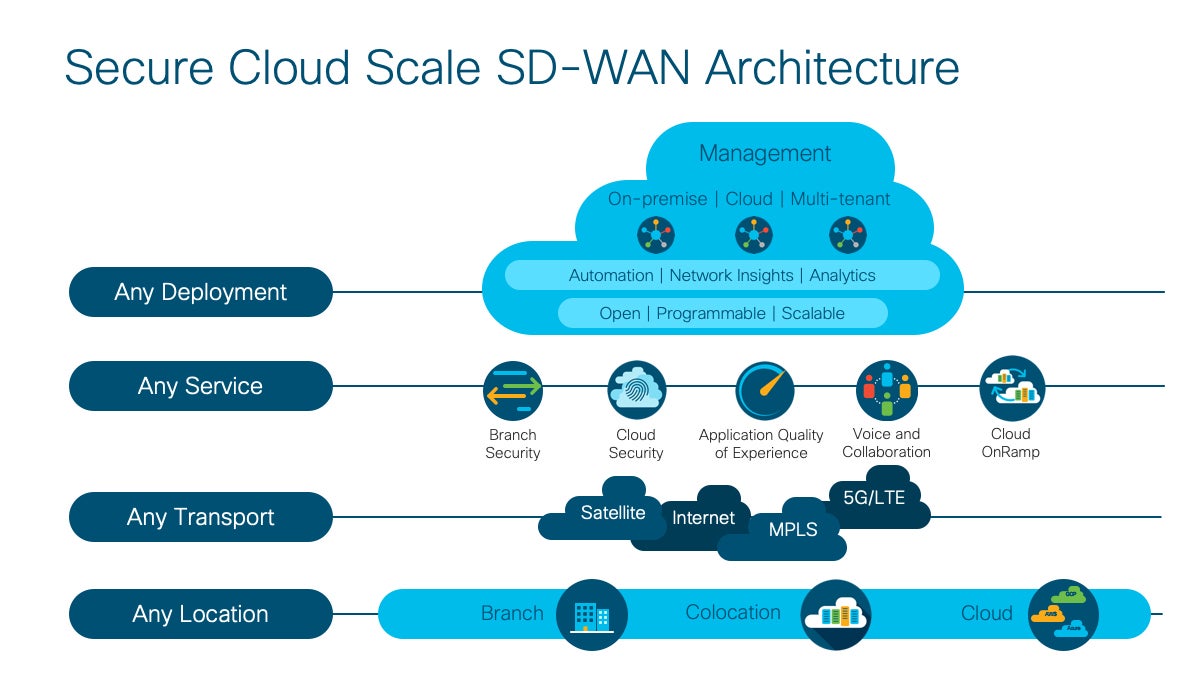

Enterprises can choose to deploy SD-WAN using one of three available models: managed, DIY, or hybrid.

In this model, companies outsource all their SD-WAN needs to a managed service provider (MSP). The service provider is responsible for configuring, monitoring, and maintaining the SD-WAN network on behalf of the enterprise.

This model offers convenience and reduces the burden on IT staff, allowing them to focus on other priorities. However, it may limit the level of control and customization available to the enterprise.

The DIY model gives enterprises complete ownership of deploying and managing their SD-WAN solution.

An organization acquires the necessary SD-WAN resources directly from a vendor and maintains the network in-house. The in-house IT team is responsible for maintaining the company’s own SD-WAN equipment, connections and software.

A DIY approach provides the highest level of control and customization but requires significant expertise and resources from the enterprise. Large enterprises looking for full network controls may find this deployment model appealing, but it may be out of reach for most small businesses.

The hybrid deployment model combines elements of both DIY and managed approaches. The enterprise retains some control over some aspects of the SD-WAN implementation while leveraging the expertise and support of an MSP. The service provider may handle certain parts of the deployment and management while the enterprise controls specific functions or policies.

Though the SD-WAN providers offer extensive functionalities and security capabilities, they may not be the best for every business. If the three providers below do not meet your needs, we reviewed the best SD-WAN vendors to help you determine the best solution for your company.

Cisco offers a cloud-based SD-WAN overlay fabric that allows enterprises to connect data centers, branches, campuses, and colocation facilities to improve network performance. Managed through the Cisco vManage console, the solution separates data and control planes to provide centralized management and control.

Cisco SD-WAN key features include:

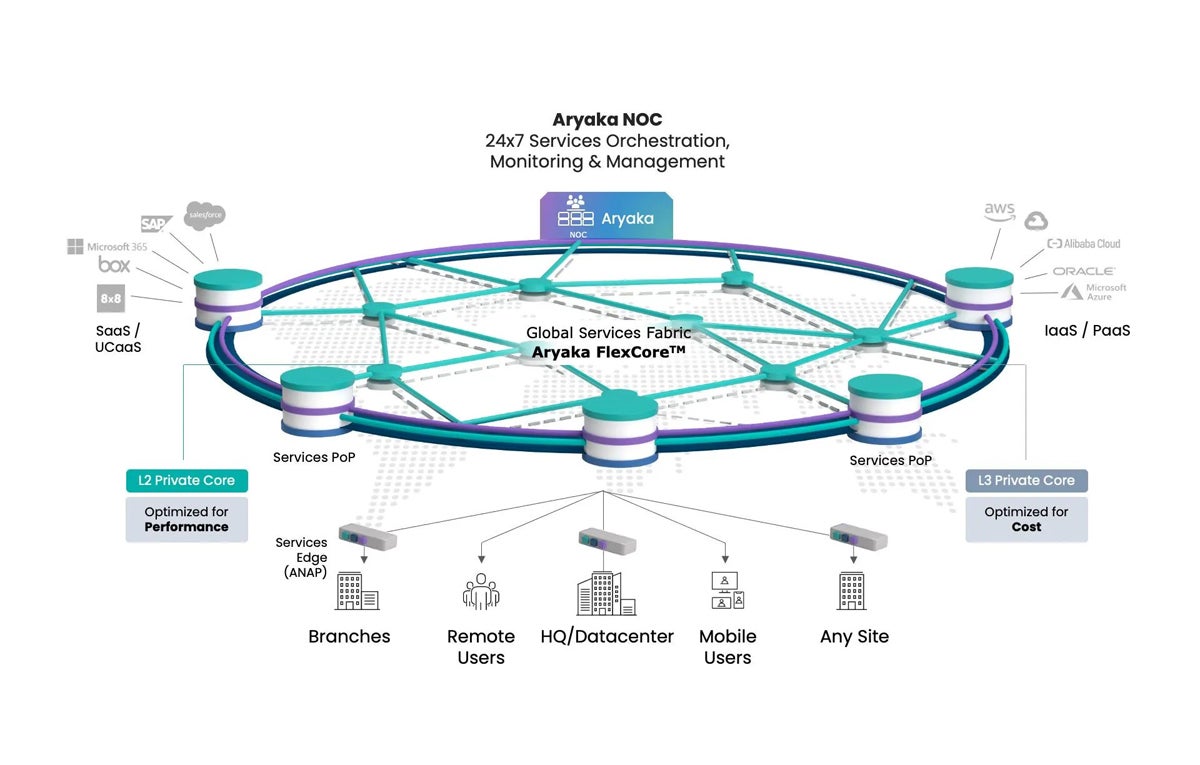

Aryaka is a managed SD-WAN service provider. Their SD-WAN service is built on a high-performance global FlexCore network, giving organizations a robust and flexible Network-as-a-Service to connect sites, users, and cloud workloads, regardless of location.

Aryaka SD-WAN key capabilities include:

Juniper Networks SD-WAN leverages AI and the Juniper Mist Cloud Architecture to provide an intelligent and automated SD-WAN solution. Their solution integrates with Juniper’s Mist AI-driven networking platform to provide end-to-end visibility and control. Juniper’s SD-WAN solution offers key features such as zero-touch provisioning (ZTP), centralized management, and advanced analytics for monitoring and troubleshooting.

Juniper Networks key features include:

SD-WAN is beneficial to organizations looking to improve their network performance and reduce costs. Businesses that are considering implementing this technology should carefully evaluate their specific needs and consider SD-WAN challenges.

Like any technology, while SD-WAN can provide organizational advantages such as increased bandwidth, improved network security, and centralized management, it also requires proper planning, deployment, and monitoring to succeed.

If you’re considering implementing SD-WAN, make sure you check out our complete guide to the best SD-WAN providers — and how to choose between them.

Aminu Abdullahi is an experienced B2B technology and finance writer and award-winning public speaker. He is the co-author of the e-book, The Ultimate Creativity Playbook, and has written for various publications, including eWEEK, Enterprise Networking Planet, Tech Republic, eSecurity Planet, CIO Insight, Enterprise Storage Forum, IT Business Edge, Webopedia, Software Pundit, and Geekflare.

Enterprise Networking Planet aims to educate and assist IT administrators in building strong network infrastructures for their enterprise companies. Enterprise Networking Planet contributors write about relevant and useful topics on the cutting edge of enterprise networking based on years of personal experience in the field.

Property of TechnologyAdvice. © 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this site are from companies from which TechnologyAdvice receives compensation. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. TechnologyAdvice does not include all companies or all types of products available in the marketplace.